A First-hand Account of Brazil Coffee Crop Conditions

A CoffeeNetwork Exclusive:

With the current state of affairs of Coffee crop in Brazil, the following is an excellent analysis by Alexis Rubinstein for CoffeeNetwork outlining exactly what is happening in Brazil and what to expect in the coming days.

By: Alexis Rubinstein

CoffeeNetwork (New York) – Since the start of the year, Brazil has received rainfall levels around 88% below average, threatening the conditions of the coffee crop. It appears the damage will be two-fold, with the market waiting to assess the damage to the 2014-2015 and 2015-2016 crop ahead of the harvest which is set to begin in May.

“No one knows how much coffee was lost, and it is way too early to ascertain, “ says INTL FCStone Senior Vice President, Albert Scalla, after returning from a 12-day trip around the major coffee growing regions of the country. “This is because this is the first time this phenomenon has ever occurred, at this time of the year. There is no record as to how the plant reacts or recovery takes place. There have been droughts in Brazil during January-February but never with this intensity or with these high temperatures.”

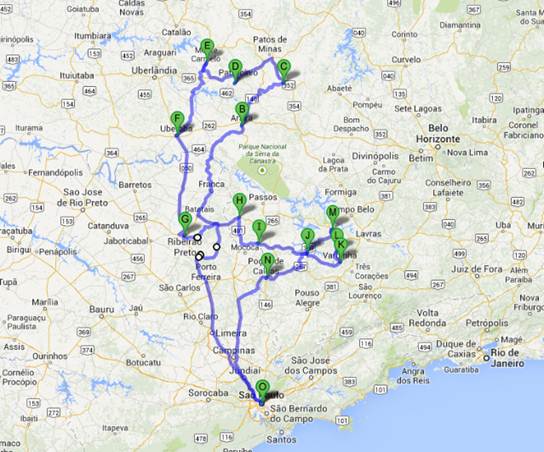

After traveling 3,345 kms through the areas of Cerrado, Alta Mgiana, Southern Minas and Southeastern Minas, it became apparent that the trees were overstressed and the lack of moisture had already started to show its impact. “Even with irrigation most coffee producers are concerned about signs of stress, especially for the new growth for next year’s crop,” said Scalla. “Next year’s harvest is where the biggest impact will be felt. Instead of the 10-12 nodules growth expected in the branches they are seeing in the area of 5 to 6 nodules.”

Big Picture, Big Problems

The problems don’t end with moisture deprived coffee trees. The recent drought has caused a snowball effect of obstacles for Brazilian coffee producers. Firstly, fertilization has been heavily reduced. “International prices kept falling, so producers held back on the second application due in November-December in order to save money,” says Scalla. But as producers were gearing up to compensate with a round of fertilizing in January-February, this was delayed as well, as fertilizer cannot be applied without rain. “Professional and large farms have cut down fertilization from 3 times to 2 times in the past 7 months, and most non -professional farms from 2 to 1 cycle of fertilization,” Scalla explains.

A heavy amount of pruning (Esqueletamento) had taken place during the past 8 months and after the harvest in order to reduce near term cost and increase productivity for the 2015 harvest. Due to falling international prices, this was also a strategy to “push costs out into the future.”

The drought-like conditions have also made the coffee trees more vulnerable to coffee pests and diseases, and outbreaks of the Cercospora fungus, Roya (the coffee leaf ruse disease), Broca and Bicho Mineiro (worms affecting the leaf) have been reported.

Also detrimental to the coffee crop, some light flowering was seen and is being reported, brought about by the dry weather. This pre-mature flowering will cause losses to the 2015-2016 crop. The tree will not be able to flower where any flowering has taken place.

Lastly, there is an increasing concern regarding possible defaults. “Bean size will also definitely be compromised,” confirms Scalla. “Screen 17/18 will be out of reach. Overall quality will also be compromised. “

Waiting for the Rain to Come

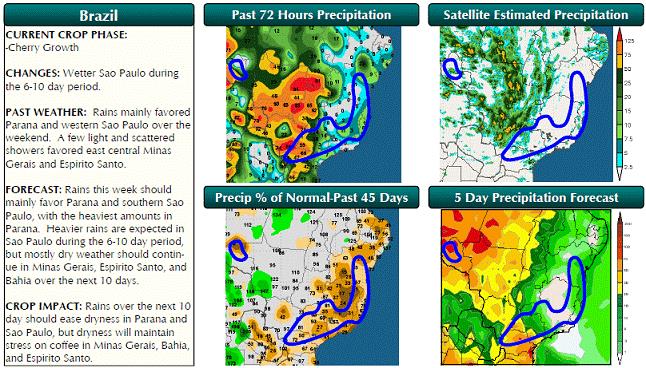

While some scattered showers have been reported throughout the coffee belt, rainfall levels are not high enough to reverse or prevent damage. According to the latest forecast from Somar Meteorologia, areas of instability bring some showers to Parana, much of Sao Paulo and southern portions of Minas Gerais in the next few days. This system should weaken without advancing further north. Over the weekend, another cold front moves up along the coast of the Southeast, and this should reach the southern part of zona da Mata. Between March 2nd-6th, rainfall will continue in the southern areas of the coffee belt. From the start of 2014, the coffee producing areas have received 1.5 inches of rain, compared to the historical average of 14 inches for the period.

From his recent trip, Scalla could see the change in crop conditions as he traveled from region to region. He noted a strong contrast from the Cerrado region to Sul de Minas. “Cerrado, being irrigated, looked lush and green with very even berry sizes and colors,” he says, “but as we passed the Alta Mogiana and down into Riberao Preto and to Southeastern Minas, plantations looked much more stressed and suffering from yellowing of the leafs. Plants were not as lush as we had seen in Cerrado. As we moved eastward in South of Minas, plantations looked under even more stress. Most large fields had a yellow/brownish tint to them instead of the dark green lush of previous trips. Young plantations 1 to 3 years of age were clearly affected.”

The dry weather has also left the reservoirs devoid of sufficient rain, removing much needed levels of security for the struggling coffee producers.

Revisions and Recalculations

Although it is certain that the Brazilian coffee crop will not survive this drought unscathed, the best anyone can do now is make educated estimates. An influx of crop forecast revisions began circulating as conditions worsened, which sent Arabica prices to multi-year highs. Olam had revised their forecast downward to 50-51 million bags; Guaxupe expects 30% of the crop to lose 10% productivity and has cut their forecast from 58 million bags to 56 million bags for the 2014-2015 crop. Ecom is also expecting losses of by 5%-10% from their initial forecast of 60 million bags.

Earlier this year, CONAB released their first estimate for the 2014-2015 crop to total between 46.53 and 50.15 million bags, which is also expected to be cut.

“In the fields, we heard numbers ranging from 10-16% of the total crop, with some going as far as 30% in farms in Southern Minas,” says Scalla.

Based on estimates, CoffeeNetwork estimates the loss to be somewhere around 4 to 6 million bags. If this were to be the case, the following could be approximated:

Original 2014-2015 world Crop 153-155 million bags

Consumption 146-147 million bags

Balance +7 to +10 million bags

Damages -4 to -6 million bags

New World balance +3 to +4 million bags

Looking ahead, the recent weather concerns have also triggered a series of added volatility events for this year, listed below:

Six expected Volatility Events: PERIOD

1) Present Drought Ongoing

2) Eventual Rains Upcoming

3) Plantation Recovery / Yields April-July

4) Winter May-July

5) Flowering Sept-October

6) Estimates of the 2015-2016 crop Nov-Dec

“We should be concerned as to not only an extended drought period but also as to this year’s winter season,” says Scalla. “There are too many correlations between the 2013-2014 climate behavior with that of the 1993-1994 climate behavior.”

The Market Makes Moves

As concerns over supplies increase, so do Arabica prices, with the most active May contract closing near 16-month highs yesterday.

“On the physical side, activity by everyone has been reported as heavy in Brazil,” says Scalla. “From a week ago since we started the push in NY, local prices have gone from 270 BRL to 440 BRL per bag. Producers were reported heavy on the offers. Three main trade house report heavy volumes of coffees traded. Brazilian producers are also taking advantage of the recent rally.”

Albert Scalla will return to Brazil during the first week in May for updated information, observations and feedback. CoffeeNetwork will report on new information as it becomes available.